Specialized Incentives & Programs

Ask about our dozens of permanent IRS tax incentives & programs.

PPP & Covid ERC/ERTC are gone. How are you replacing this money?

Watch Here

There Is A Tax Credit For That!

Optimal Business Strategies delivers the highest standard of service in the industry, offering a unified solution to secure the most comprehensive federal, state, and local tax credits and incentives.

To address the various challenges businesses face in pursuing financial savings and reinvesting in their operations, Optimal Business Strategies has tailored our team and processes to cater to the unique industry, circumstances, and objectives of each client.

Our experts collaborate closely with our client's CPA and accounting personnel, ensuring seamless integration of these valuable tax credits into each project, thereby maximizing benefits and enhancing overall business growth.

Cost Segregation

Maximize your cash flow by reclassifying certain building costs to accelerate depreciation

WOTC

A tax credit created to motivate businesses to hire individuals from specific target groups.

R&D Tax Credit

Inspire innovation and offset research and development expenses with this valuable tax credit.

Property Tax Reduction

Minimize property tax burdens through strategic planning and evaluation of property assessments.

ERC

Emergency Employee Tax Credit

Additional Services

Reduce Costs, Increase Cash Flow

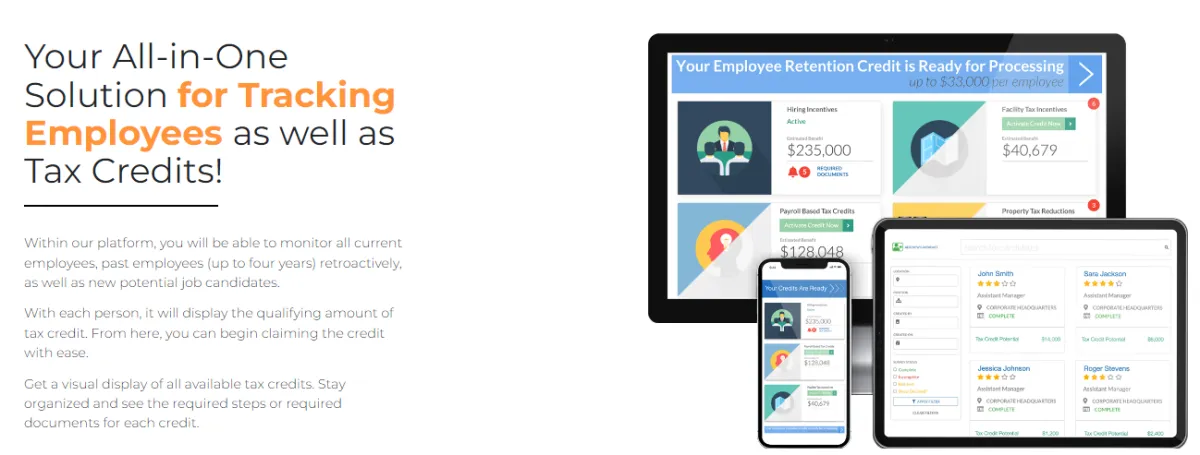

We Make Claiming Tax Credits Easy!

We've been a leader in the Specialized Tax Incentive field for over

twenty-five years.

We're proud to share that we have

identified over $37B in tax credits and incentives for our clients.

Let our expertise work for you.

Our team of professionals will navigate the process for you

and get your tax credits immediately.

Research and Development (R&D) Tax Credit

The Federal Research and Development (R&D) Tax Credit, outlined in Section 41 of the Internal Revenue Code (IRC), is tailored for American enterprises, assessing their operational and process-based activities to establish eligibility for tax incentives. This initiative allows organizations to reclaim tax payments from past years while also offering a dollar-for-dollar reduction in their current taxable income.

At OBS, we partner with a team of experts with extensive backgrounds in engineering ensures adherence to the IRS's stringent project-specific evaluation criteria. This approach guarantees the comprehensive identification and qualification of all relevant employees, their activities, the time invested, and the wages disbursed, thereby maximizing the financial benefit for our clientele.

On average, conducting an R&D Tax Credit analysis can result in savings of $20,000 to $40,000 for every $1 million in total payroll expenses of a company. Firms have the potential to claim these benefits for three previous tax years, in addition to the year in progress.

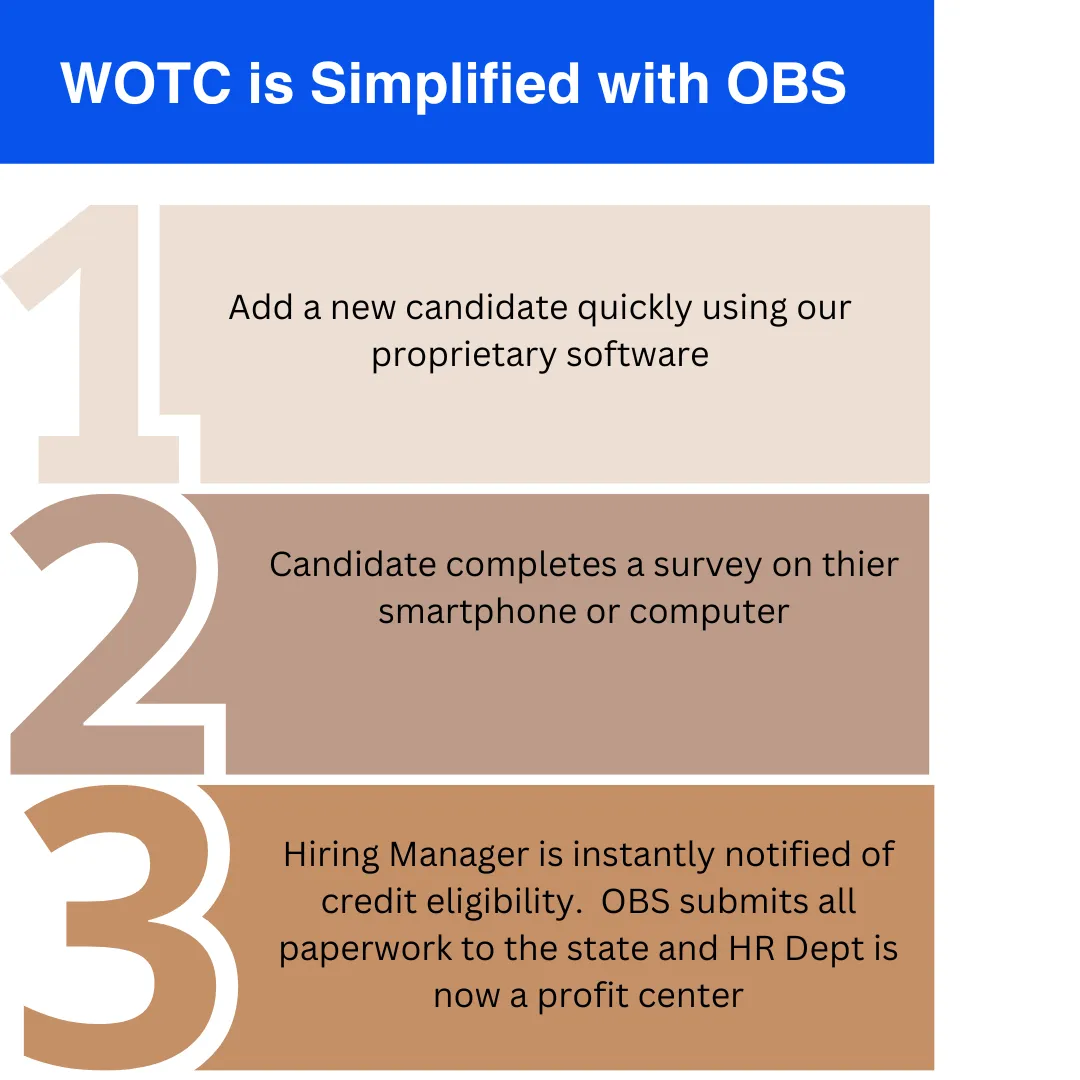

(WOTC) Worker Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a program at the federal level that offers tax incentives to employers for the hiring of individuals who meet certain qualifications. Annually, employers benefit from more than $1 billion in tax credits thanks to this program, with no required minimum number of hires to be eligible for the credit. The effectiveness and expansion of this tax credit not only support participating businesses but also contribute to the economic growth and productivity of the country.

In the past, navigating the WOTC qualification process has been a daunting and time-intensive task. Our partner, GMG Savings has addressed these challenges by investing in advanced proprietary technology designed to simplify the process for employers. Our technology significantly reduces the effort by automating the prescreening and certification of eligible candidates, as well as facilitating the submission of necessary documents on behalf of the employer.

By hiring individuals from these groups, your business can qualify for tax credits ranging from $2,400 to $9,600 per eligible employee.

Who Qualifies?

Veterans

SNAP benefit recipients

Designated community residents

SSI recipients

Long-term family assistance recipients

Vocational rehab referrals

The Work Opportunity Tax Credit offers businesses a compelling incentive to hire individuals from targeted groups who face barriers to employment. By leveraging the WOTC, businesses can access valuable tax credits, diversify their workforce, and demonstrate their commitment to social responsibility. With its potential for significant financial savings and positive social impact, the WOTC presents a win-win opportunity for businesses looking to optimize their hiring strategies.

Our approach begins with a thorough assessment of your hiring practices to identify eligible employees from target groups such as veterans, individuals receiving SNAP benefits, and ex-felons. We then guide you through the necessary paperwork, ensuring compliance with all federal regulations and maximizing your tax credits. Our dedicated team remains committed to providing personalized assistance at every step, from initial evaluation to final claim submission, guaranteeing that you harness the full potential of WOTC to both enhance your bottom line and foster social responsibility within your organization.

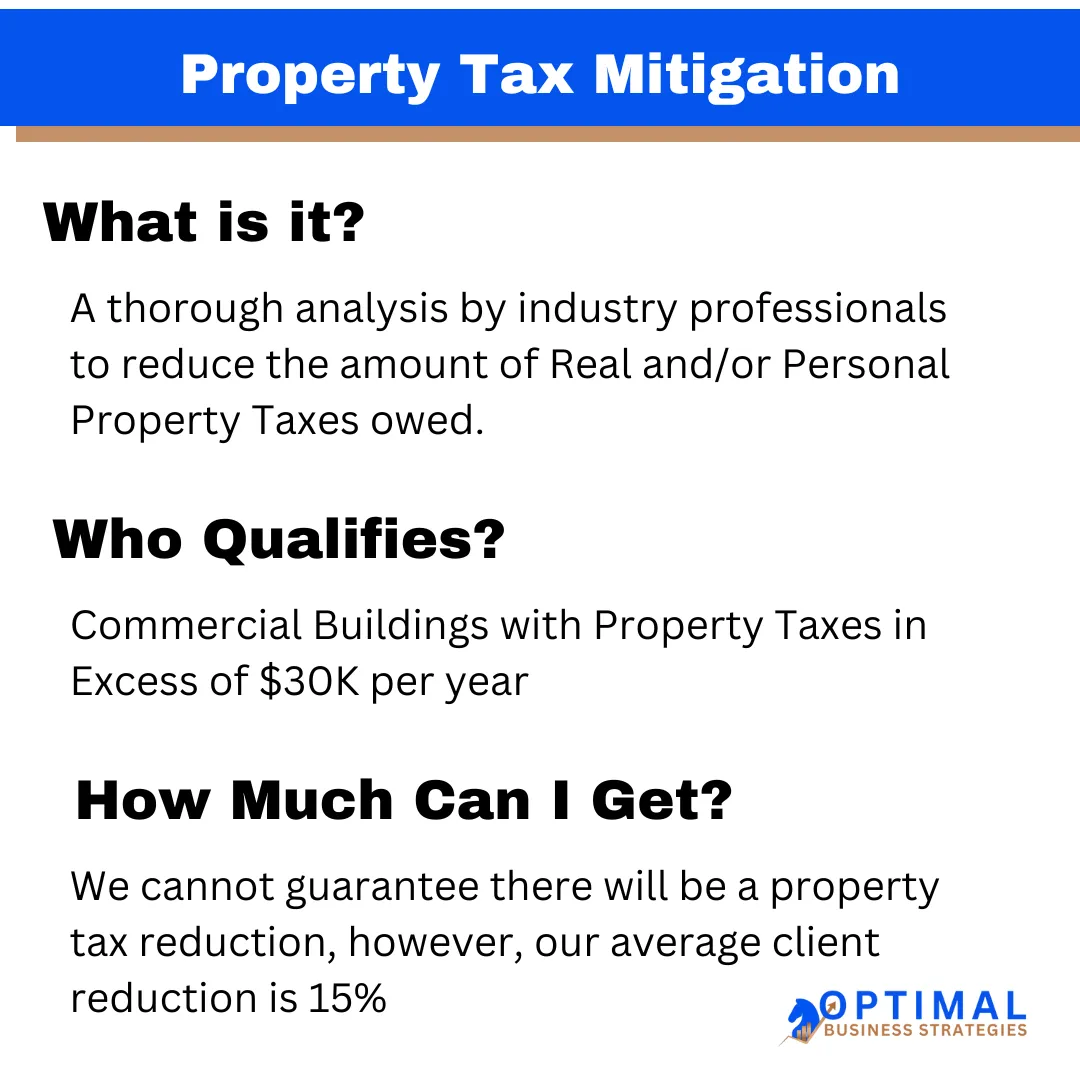

Property Tax Mitigation

Maximize Your Commercial Property's Profitability

Beyond income taxes, commercial property owners often find property taxes to be their most significant recurring financial obligation. In numerous states, the law mandates that both real and personal property be subject to taxation. These taxes represent a major outlay and consistently impact profitability.

To ensure that your property taxes are not disproportionately high, it's crucial to engage a professional with deep expertise in valuation, taxation, and legal matters related to property.

Our team, skilled in the areas of tax mitigation, property valuation, assessments, and legal advocacy, will diligently pursue every avenue to secure refunds and decrease your property tax liabilities.

We advocate on your behalf, engaging in negotiations, participating in appeal hearings, and managing all requisite documentation. Consider us an ally in your interactions with tax authorities, dedicated to minimizing your tax obligations.

The direct advantage of working with us is a tangible reduction in your tax payments, including the possibility of securing refunds for overpayments made in the past. Additionally, you'll benefit from a lighter tax load in the future, enhancing your business's financial health through improved cash flow.

Several Factors That We Evaluate:

Property Assessment Accuracy

Valuation Methodology

Exemptions and Abatements

Property Condition

Comparable Properties

Appeal Process

Tax Incentives and credits

Legal Considerations

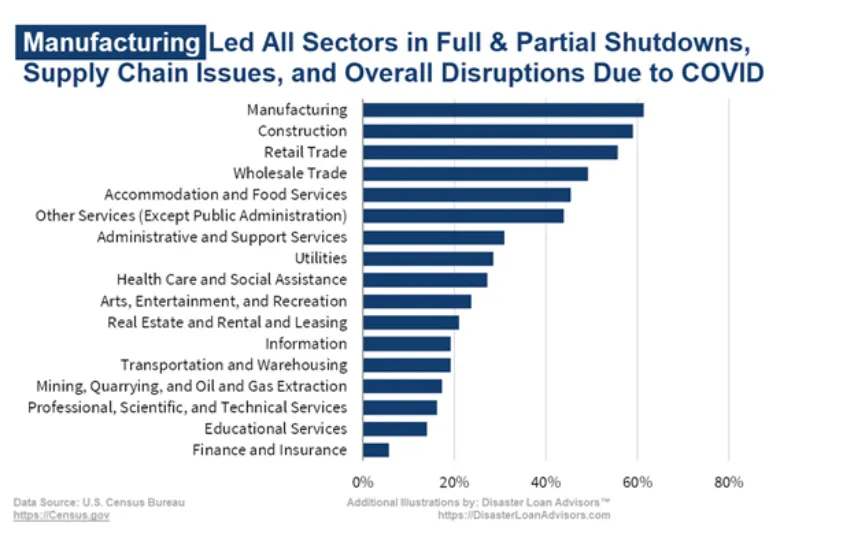

Employee Retention Credit (ERC)

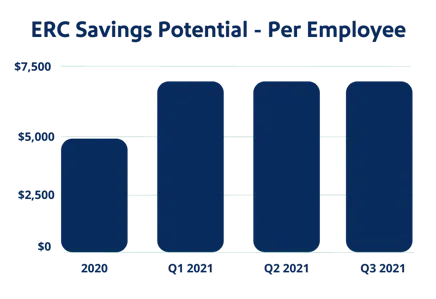

In response to the federal effort to mitigate the economic impact of the pandemic, Congress enhanced a pre-existing tax incentive, the Employee Retention Credit (ERC), aiming to motivate businesses to retain their staff. With ongoing adjustments to the ERC, it has become accessible for almost every business, offering a significant opportunity to employers. A qualified employee can contribute up to $26,000 to their employer through this credit. Here's an overview of eligibility criteria and the mechanism for claiming the credit.

Mechanism for Claiming the Credit:

The ERC is applied as a reduction to your employer portion of Social Security taxes owed. Should the credit exceed the amount of Social Security tax due, the surplus is refunded directly by the IRS. Employers typically claim this credit on their quarterly federal tax filings using Form 941, the Employer's Quarterly Federal Tax Return.

For those who discover they are eligible after having filed their taxes, an amendment to Form 941 can be submitted. Furthermore, eligible businesses may request an advance on the ERC by reducing the payroll taxes forwarded to the IRS, enabling immediate benefit from the credit.

Eligibility Criteria:

Eligible entities include private sector employers and non-profits that meet any of the following conditions:

- Operations that are either fully or partially halted due to COVID-19 restrictions.

- A noticeable reduction in gross receipts due to the pandemic.

- Newly established businesses (startups) during this period.

- Employers who have received Paycheck Protection Program (PPP) loans are still eligible for the ERC, offering a broader scope for aid during these challenging times.

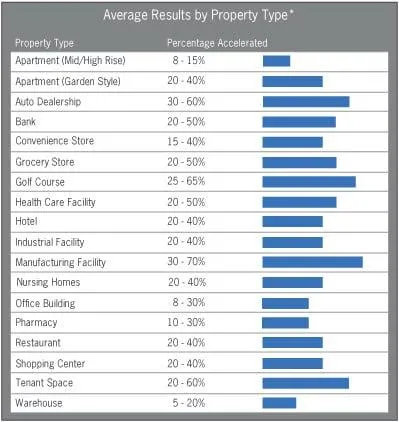

Remote Real Estate Cost Segregation Studies

Studies that Maximize Depreciation

Asset Classes We Examine:

Real Property (Building Structure)

Personal Property (Furniture, Fixtures, Equipment

Land Improvements (Landscaping, Parking, etc)

Conducting a Cost Segregation Study based on engineering principles grants commercial real estate proprietors a tactical edge by enabling the reassignment of their property classifications from real to personal for the purposes of tax depreciation.

This reallocation serves as an essential financial maneuver that substantially boosts cash flow both in the immediate future and over an extended period.

By pinpointing and segregating the elements of their property that qualify for depreciation over a reduced timeframe, proprietors are positioned to benefit from expedited depreciation techniques.

OBS partners with a cadre of professional, certified experts who adhere to the Detailed Engineering Approach recognized by the IRS for executing all Cost Segregation Studies. This approach ensures the maximization of benefits while guaranteeing compliance with IRS regulations.

Typically, a Cost Segregation Study can yield about $150,000 in extra depreciation for every $1 Million spent on purchasing or building, compared to the traditional 39-year straight-line depreciation method.

Determining the eligibility of building components or improvements for a cost segregation study involves evaluating several factors to ensure compliance with tax regulations. Here are some criteria typically considered:

Time of acquisition or construction: Assets must have been acquired, constructed, or substantially renovated after 1986 to qualify for cost segregation.

Useful life: Assets should have a determinable useful life separate from the building itself. Examples include certain types of equipment, specialized lighting systems, HVAC units, and plumbing fixtures.

Depreciation recovery period: Assets must have a shorter depreciation recovery period than the building itself. For example, while buildings generally have a recovery period of 27.5 or 39 years, eligible assets might have a recovery period of 5, 7, or 15 years.

Separability: Assets must be identifiable and separate from the building structure. This means they can be removed, replaced, or renovated independently without significantly affecting the overall structure.

Documentation: Detailed records such as construction drawings, invoices, purchase orders, and asset listings are crucial for substantiating the cost segregation allocations.

Taxpayer intent: The intent at the time of acquisition or construction should align with the purpose of claiming accelerated depreciation. This means the taxpayer must have intended to use the assets separately from the building to qualify for shorter depreciation periods.

Compliance with IRS guidelines: Cost segregation studies must adhere to IRS guidelines and regulations to ensure accuracy and compliance. Working with qualified professionals familiar with these guidelines is essential (MACRS).

By carefully evaluating these factors, property owners can determine the eligibility of building components or improvements for inclusion in a cost segregation study, maximizing tax benefits and optimizing cash flow.

Operational Cost Reduction

We use a dual pronged approach. We look back in time to recapture refunds and we look forward for future savings opportunities

Our PROCESS

Based on our in-depth analysis and easy to use proprietary Tax Management Software, we carefully examine your business, find significant savings and then provide you results and solutions

Our PROMISE

We save you money, or you do not pay us. We work on a contingency fee for our profit enhancement services so there is no risk, no obligation and no out of pocket costs.

We deliver cutting-edge cost-saving solutions and expense reductions to businesses across the USA

We get paid only a percentage of what we recover.

Legal

© Copyright 2022. Optimal Business Strategies. All rights reserved.

Privacy Policy